Get the free instalment sales accounting problems and solutions

Show details

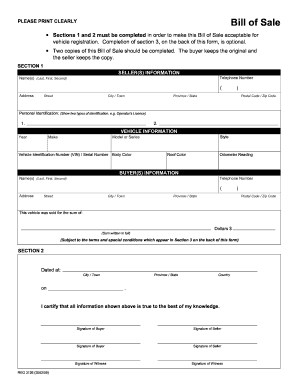

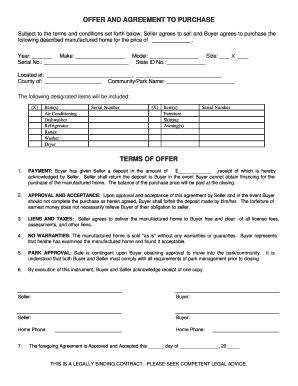

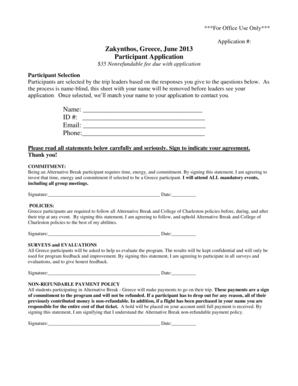

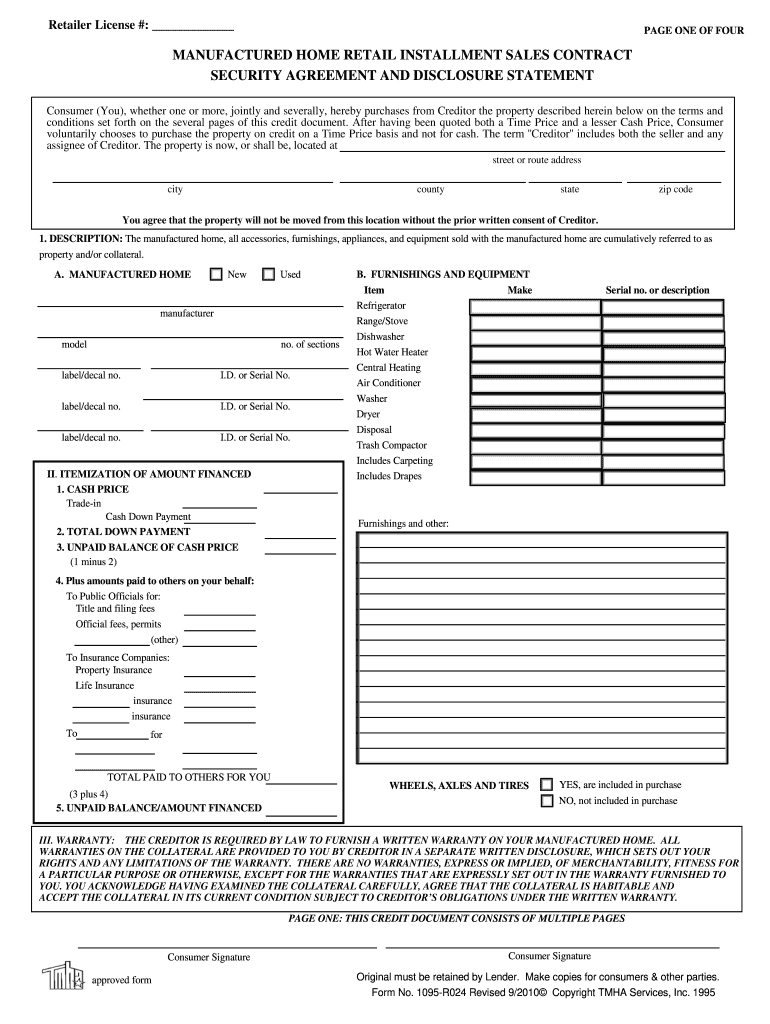

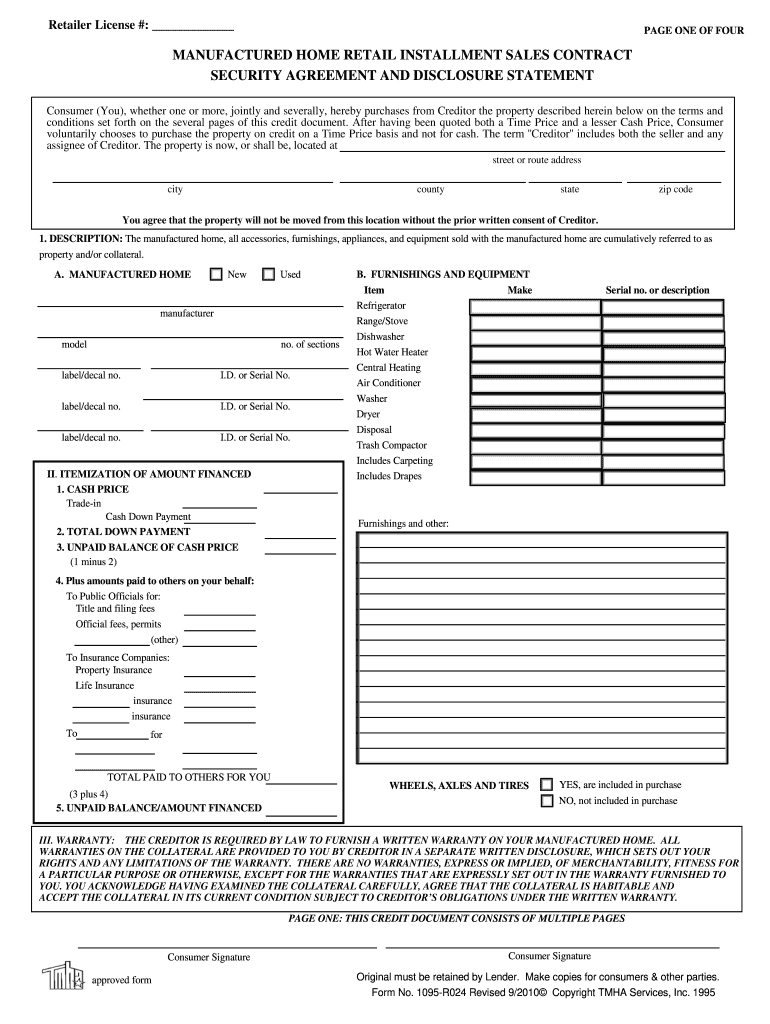

Retailer retail License #: PAGE ONE OF FOUR MANUFACTURED HOME RETAIL INSTALLMENT SALES CONTRACT SECURITY AGREEMENT AND DISCLOSURE STATEMENT Consumer (You), whether one or more, jointly and severally,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your installment sale form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mobile installment form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retail installment sales contract online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit instalment form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out instalment sales accounting problems

How to fill out an installment sales quiz:

01

Start by reading the instructions and understanding the requirements of the quiz.

02

Gather all the necessary materials and resources that you may need to complete the quiz, such as textbooks, lecture notes, or additional readings.

03

Create a study plan and allocate enough time to review the relevant concepts and topics related to installment sales.

04

Take thorough notes during your study sessions to help you remember important information.

05

Practice solving sample problems or questions similar to those that may be asked in the quiz to enhance your understanding and problem-solving skills.

06

Prioritize understanding the key principles and rules of installment sales, including the calculation of interest, payments, and the recognition of revenue.

07

If there are any specific formulas or equations that need to be memorized, make sure to practice and familiarize yourself with them.

08

On the day of the quiz, ensure that you have a clear understanding of each question before answering.

09

Double-check your answers for accuracy and completeness before submitting the quiz.

Who needs an installment sales quiz:

01

Students studying accounting or finance courses that cover topics related to installment sales.

02

Professionals working in the finance or accounting industry who deal with installment sales transactions.

03

Individuals interested in learning and improving their knowledge of installment sales methods and calculations.

Fill

form

: Try Risk Free

People Also Ask about

What is an installment sale for GAAP purposes?

An installment sale is one of several possible approaches to revenue recognition under the rules of Generally Accepted Accounting Principles (GAAP). More specifically, this method accounts for when revenue and expense are recognized at the time of cash collection rather than at the time of sale.

What is an example of installment sales method?

For example, Real Estate Company has just sold a large parcel of land to Case Co. at a price of $1 million. Case signed an installment sales contract that requires payments of $150,000 over the next 6 years and an up-front payment of $100,000. The cost of the land sold for Real Estate is $600,000.

What is the formula for installment sales?

There are three important formulae for installment sales calculations: Gross Profit = Selling Price - Adjusted Basis. Gross Profit Percentage = Gross Profit / Selling Price. Gain Recognized or Taxable Gain = (Cash Collection excluding Interest) * Gross Profit Percentage.

What is an example of installment?

Examples of installment buying would be a home, a car, or other large purchases that require financing, such as a laptop. It allows the purchaser to buy without paying the entire amount upfront.

How do you calculate capital gains on installment sale?

The amount of gain reported from an installment sale ( ¶1801) in any tax year (including the year of sale) generally is equal to the payments received during the year multiplied by the gross profit ratio for the sale ( Code Sec. 453(c); Temp.

What is the installment method of sales?

Under the installment method, you include in income each year only the part of the gain you receive or are considered to have received. You don't include in income the part of the payment that's a return of your basis in the property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute instalment sales accounting problems online?

Filling out and eSigning instalment sales accounting problems is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the instalment sales accounting problems in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your instalment sales accounting problems.

How can I fill out instalment sales accounting problems on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your instalment sales accounting problems. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is quiz of instalment sales?

The quiz of instalment sales refers to a financial assessment or calculation used to determine the tax liability or reporting requirements associated with sales made on an instalment basis.

Who is required to file quiz of instalment sales?

Individuals or businesses that sell goods or services on an instalment basis, where payments are made over time, are typically required to file a quiz of instalment sales for tax reporting purposes.

How to fill out quiz of instalment sales?

To fill out a quiz of instalment sales, one must gather relevant sales data, calculate total sales, determine the instalment amounts, and report these figures accurately on the designated tax form or assessment questionnaire.

What is the purpose of quiz of instalment sales?

The purpose of quiz of instalment sales is to ensure proper tax compliance and reporting for sales made on an instalment basis, allowing tax authorities to assess income earned from these sales appropriately.

What information must be reported on quiz of instalment sales?

Information that must be reported includes the total sale price, number of instalments, amount received in each instalment, dates of payments, and any interest charged on the instalments.

Fill out your instalment sales accounting problems online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Instalment Sales Accounting Problems is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.